Business

Introduction to REITs

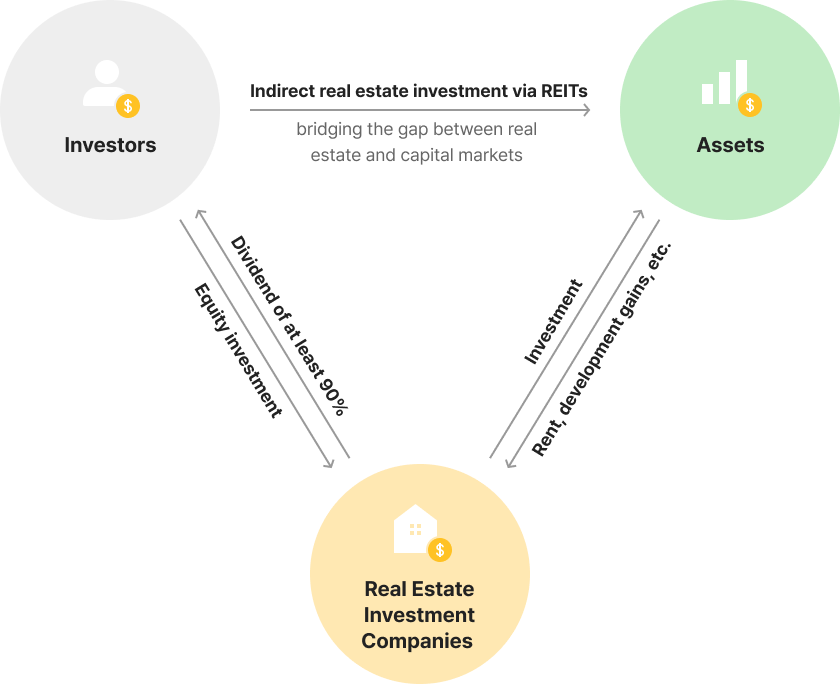

REITs Stand for real estate investment trusts (REITs), which pool the capital of numerous investors,

making it possible for individuals to earn dividends from real estate investments

without having to buy, manage, or finance any properties themselves.

REIT Structure: How They Work

Advantages of Investing in REITs

-

Tax Benefits

Benefits from property taxes and comprehensive real estate taxes,

corporate tax deductions when distributing more than a certain

percentage of distributable profits, income deductions from real

estate rental income for self-managed real estate investment companies,

and tax savings from real estate sales. -

Liquidity

After investing in REITs, it can be easily converted

into cash through stock trading on the over-the-counter market,

and liquidity can be secured through stock trading

on the Korea Exchange when listing REITs. -

Smart Investment on a Small Budget

Buildings can be bought in small amounts,

allowing investors to partially own them

for relatively small amounts of money. -

Disclosure Obligations

Investment and operating reports, including quarterly

and annual financial reports, are registered in the REIT

information system, and materials are regularly

disclosed as the basis for investment judgment

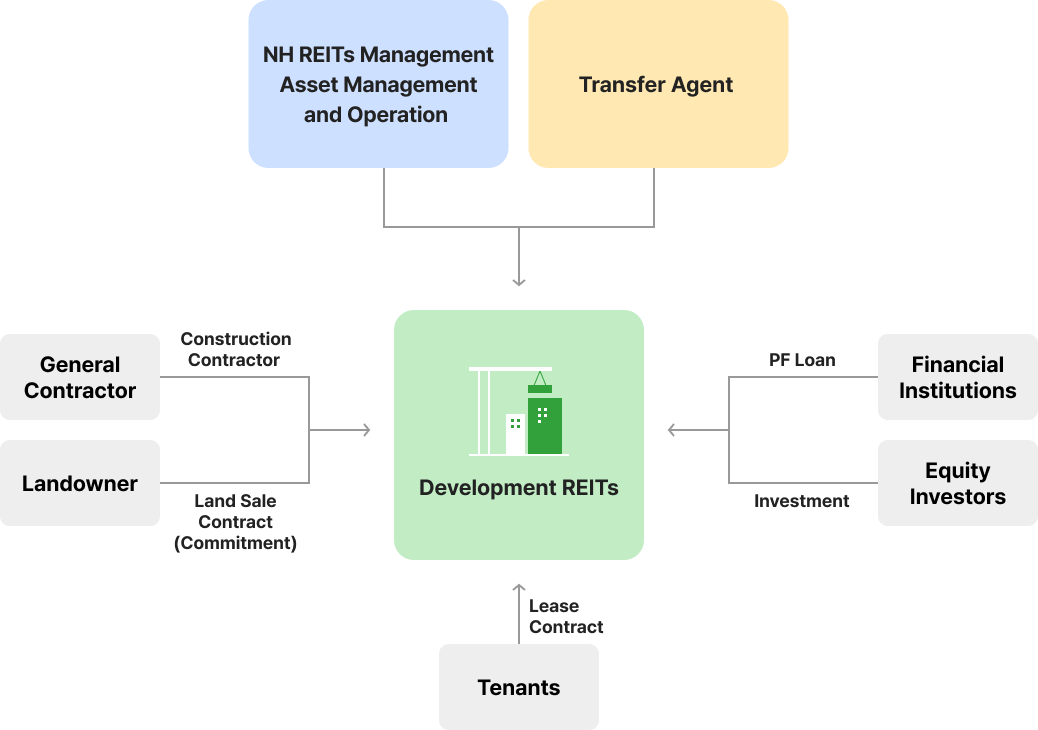

Development Projects

Development REITs act as a hands-on operator of real estate development projects.

It can be developed directly like typical development projects, and all or part of the project under construction can be sold to REITs.

Development REIT Structure

In the case of development REITs, asset management companies participate in the project at all stages, including business feasibility review, financing discussions, development approval, and completion, as the actual business operator of the real estate development project.

While it may take some time for the investment period compared to pre-purchased REITs, high return on investment can be expected.

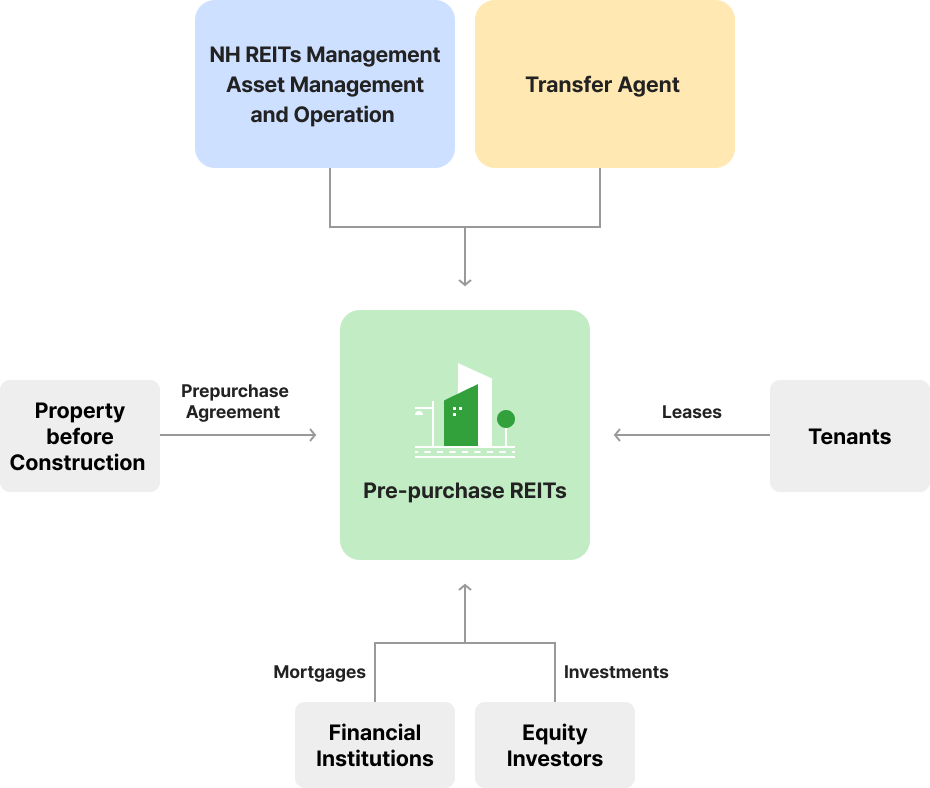

Pre-purchase REITs structure

A pre-purchased REIT participates in the development stage and operation after construction is completed.

Responsible for the composition and purchase of tenants before completion, Development REITs have high risks, but it can be expected to have a higher return than the actual purchase, since it is purchased at a low